AI Tools are becoming much more intimidating subject that is reshaping all factors of our lives, that includes healthcare, transportation and investments and finance.

See, Artificial Intelligence (AI) is basically a collection of technologies that can able to perform tasks that were previously thought to be exclusive only for humans, such as understanding patterns, creating art, critical decision making. We now entered a new era of computing where programs can learn from data, automate complex activities and it can improve over time. With that AI crypto trading is beginning to shine in the tech world.

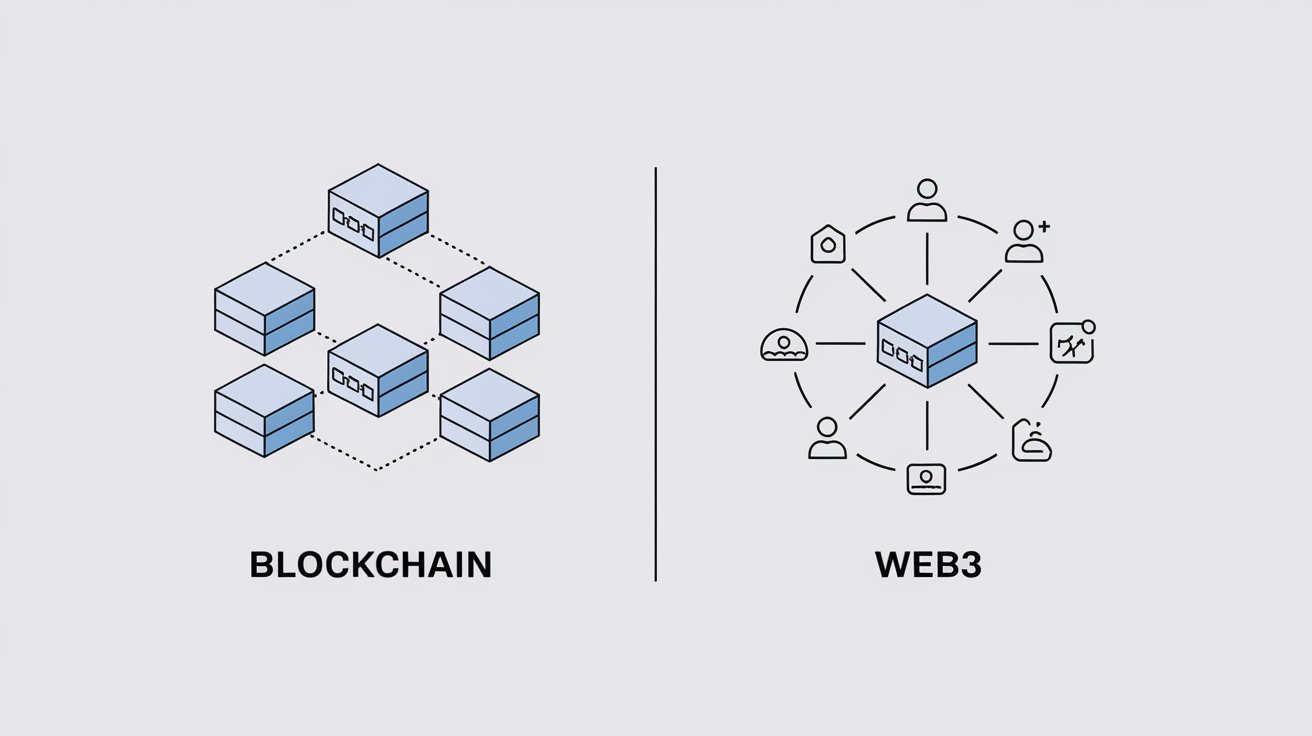

Cryptocurrencies are a decentralized digital currency, meaning a central authority does not govern them. Instead, they are built on a blockchain technology, a distributed ledger that records all transactions. Basically, it has been providing an alternative means of exchange that has real value, and can use as an investment also buy stuffs. So cryptocurrencies have the potential to destabilize established financial systems.

Now that AI has entered the frame, there has been so many controversies and discussion that everyone should know. What is up ahead in the future of digital finance and what is AI crypto trading?

How AI Algorithms Are Shaping Cryptocurrency Investments

AI powered algorithms are rapidly changing the way investors approach cryptocurrency. Programs are created for understanding and work on data. These programs or algorithms analyze massive amounts of data and assist investors to make better informed decisions based on real time insights.

AI Tools like Coinbase Analytics are capable of identifying market trends and providing investors with actionable insights. By leveraging machine learning, these algorithms detect patterns that would be hard for human investors to spot.

If you still confused about how AI can help make smarter investment decisions in crypto? Well, with AI algorithms constantly improving, even a novice investors can gain an edge in the crypto market. Or use as a research purpose.

Are AI Trading Bots Worth the Trust?

Thinking about letting AI handle your trades? While these bots can be efficient, they’re not always perfect. AI bots operate based on pre-defined algorithms that make rapid decisions in unstable markets. While they can optimize trades and minimize human error, they are not foolproof and can sometimes make an error. We know, Crypto market is very much unpredictable so, learn and do your own research before using them.

AI Tools That Can Assist You in Crypto Market

AI-powered crypto bots like CryptoHopper are automating trades for investors, but can you trust them with your hard-earned money? These bots promise efficiency, but concerns about reliability remain.

Another helpful AI Tool Hummingbot that is designed to analyze market sentiment and adjust trading strategies in real time. By reacting faster than human traders, this AI can help reduce market instability and prevent sudden price swings.

By now, you might be thinking is there an AI that can predict market crashes? There is, AI tools like Numerai and Endor use predictive analytics to assess the likelihood of market crashes. Although they aren’t always accurate, but provides valuable insights and potential risks.

Worried about falling victim to a crypto scam? Tools like Chainalysis and Crystal use AI to analyze blockchain transactions in real-time. Detecting irregular signal patterns like money laundering, hacking, or fraud. These systems act as a safeguard, protecting both investors and exchanges.

AI and Decentralized Finance (DeFi): How AI and Blockchain Can Reshape The Future of Finance

Artificial Intelligence (AI) and Blockchain have become two of the most troublesome forces in the financial world, particularly in Decentralized Finance (DeFi). AI’s predictive algorithms, data analysis capabilities, and automation tools are revolutionizing how DeFi operates, while blockchain provides an unchangeable and secure infrastructure. Together, they are transforming and obtaining the world of cryptocurrencies.

The Role of AI in Decentralized Finance (DeFi)

AI’s contribution to DeFi lies in its ability to analyze large volumes of data and generate insights that help traders make smarter decisions. AI algorithms are used to predict market trends, optimize trading strategies, and automate transactions. In the realm of DeFi, where Transparency and Efficiency are key, AI contributions in liquidity management, lending protocols, and risk assessment by processing data at unparalleled speed and accuracy.

AI tools like Kava and Aave are being integrated into DeFi platforms to optimize transactions and smart contracts.

For example, AI-powered tools can assess a borrower’s creditworthiness by analyzing their transaction history on the blockchain. It allows decentralized lending platforms to operate more smoothly and safely without relying on traditional credit scoring systems.

- According to a Report by Deloitte, “AI-driven solutions can increase the transparency and efficiency of DeFi lending protocols by leveraging data from blockchain transactions.”

- A study from The World Economic Forum highlighted, “How AI is improving DeFi trading accuracy by analyzing complex market data in real-time.”

AI and Blockchain: Reinforcing Crypto Security

While AI is transforming financial systems, blockchain is ensuring the security and integrity of those systems. Blockchains decentralized nature allows for a transparent, tamper proof ledger, making it difficult for malicious actors to manipulate data. By integrating AI, the level of security in blockchain ecosystems can be enhanced further. AIs machine learning algorithms are particularly effective in detecting fraud, identifying patterns of cyber attacks, and reduces potential security breaches.

Tools like DeepMind’s AI are being integrated into blockchain networks to ensure the integrity of transactions.

For instance, AI powered fraud detection systems can scan blockchain networks for irregular transactions, flagging suspicious activity long before human analysts could detect it. Moreover, AIs predictive analytics can help prevent attacks by analyzing past security events and spotting patterns that might indicate an impending threat.

- IBMs recent blockchain security report indicates that, “AI-enhanced blockchain systems are 20% more effective in detecting fraud and abnormal activities.”

- An MIT Technology Review article discussed, “How AI is enabling decentralized platforms to better manage security vulnerabilities, including predicting and preventing 51% attacks on blockchain networks.”

This combination of AIs ability to manage decentralized finance (DeFi) and blockchains security infrastructure ensures that cryptocurrency markets become more efficient, transparent, and safe. The partnership of these two technologies is likely to shape the future of finance in a powerful and unpredictable ways.

Ethical Concerns Around AI in Cryptocurrency

AI is advancing rapidly in the cryptocurrency space, but is it outpacing regulation? Concerns about data privacy, market manipulation, and accountability are growing as AI becomes more integrated into crypto operations.

While AI offers efficiency and innovation, the lack of clear regulations raises ethical questions. Can governments keep up with the rapid growth of AI in crypto? What happens if an AI driven trading bot malfunctions or is used unethically?

Nevertheless, this concern is becoming harder to ignore. For keepsake, Regulators must create frameworks that address AI transparency, accountability, and fairness while ensuring that the technology’s potential benefits aren’t stifled. This action requires collaboration between tech developers and regulatory bodies to establish ethical guidelines that keep up with AI’s advancements in the crypto world.

AI’s Impact on the Efficiency of Crypto Mining

AI is revolutionizing the crypto mining process by optimizing resources and reducing energy consumption. This is making mining more profitable while resolving environmental concerns.

AI algorithms, like DeepMind, are helping miners optimize their operations by reducing the computing power needed for mining. This leads to lower energy costs and a more sustainable approach to cryptocurrency mining.

Will AI Crypto Trading Replace Human Traders in Cryptocurrency Markets?

While AI bots can handle high frequency trading with precision, they lack the emotional intelligence and market intuition that experienced traders possess. There are Advantages and Limitations of AI that can never be resolved.

Future Collaboration Between AI and Human Traders:

The future of AI crypto trading will likely see collaboration rather than competition between AI and human traders. AI can handle the heavy lifting of data analysis, pattern recognition, and executing routine trades, while human traders can focus on strategic decision-making, understanding market sentiment, and reacting to unforeseen events.

This hybrid approach would allow traders to benefit from the strengths of both AI and human intuition, making trading more efficient without losing the nuanced insight that human experience brings.

In conclusion, while AI is revolutionizing the way crypto markets operate, human traders are far from obsolete. Instead, a future where AI and humans work together seems the most promising, harnessing the best of both worlds to navigate the complication of the crypto market.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/en-IN/register?ref=UM6SMJM3

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/es-MX/register?ref=JHQQKNKN

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/pt-BR/join?ref=YY80CKRN

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.com/zh-TC/register-person?ref=VDVEQ78S

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/ar/register-person?ref=V2H9AFPY

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/bg/register?ref=V2H9AFPY

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Tell me about your doubts. I’ll try to clear your thoughts

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.info/fr-AF/register-person?ref=JHQQKNKN

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.info/en-IN/register-person?ref=UM6SMJM3

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/join?ref=P9L9FQKY

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.info/id/register-person?ref=GJY4VW8W

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/ph/register?ref=B4EPR6J0

whoah this weblog is excellent i like reading your posts.

Keep upp the greatt work! You understand, a lot of people

are searchinjg round for this info, you could aaid them greatly. https://glassi-App.blogspot.com/2025/08/how-to-download-glassi-casino-app-for.html

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.info/ru-UA/register-person?ref=OMM3XK51

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/en/register?ref=JHQQKNKN